[ad_1]

In the previous quarter, EastGroup Props (NYSE:EGP) has observed the following analyst scores:

| Bullish | Relatively Bullish | Indifferent | To some degree Bearish | Bearish | |

|---|---|---|---|---|---|

| Overall Ratings | 4 | ||||

| Very last 30D | 1 | ||||

| 1M Ago | 2 | ||||

| 2M Ago | |||||

| 3M Ago | 1 |

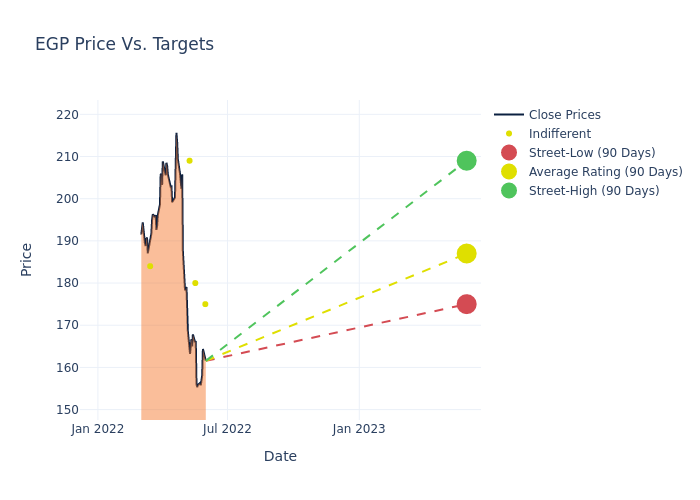

In the last 3 months, 4 analysts have available 12-month selling price targets for EastGroup Props. The business has an common price concentrate on of $187. with a higher of $209.00 and a reduced of $175.00.

Under is a summary of how these 4 analysts rated EastGroup Props above the previous 3 months. The higher the number of bullish rankings, the a lot more good analysts are on the stock and the larger the amount of bearish scores, the additional adverse analysts are on the inventory

This latest typical signifies a 11.27% decrease from the preceding common rate concentrate on of $210.75.

Scores appear from analysts, or specialists in banking and financial techniques that report for distinct shares or described sectors (generally the moment per quarter for just about every stock). Analysts commonly derive their information from business convention phone calls and conferences, monetary statements, and conversations with vital insiders to achieve their selections.

Some analysts also offer you predictions for helpful metrics this sort of as earnings, income, and development estimates to present additional direction as to what to do with particular tickers. It is vital to continue to keep in head that while stock and sector analysts are experts, they are also human and can only forecast their beliefs to traders.

This post was produced by Benzinga’s automated information engine and reviewed by an editor.

[ad_2]

Supply connection